At the 2018 IUMI conference in Cape Town, the Facts and Figures (F&F) Committee gave its usual update on the macroeconomic environment and shipping market (presented by Donald Harrell, Chair) and the global marine insurance market (presented by Astrid Seltmann, Vice Chair).

F&F member Dave Matcham updated delegates on IUMI’s major claims database project and gave a glimpse into the results of the 2017 pilot. Guest speaker Thea Fourie, from IHS Markit in Johannesburg, rounded off the session and added a local perspective by giving an overview on medium term risks and opportunities in the Sub-Saharan African market.

Facts & Figures committee work

The core of the committee’s annual work is the production and publication of extensive statistics in spring and autumn, which provide insight into the trends in the marine industry in general, and marine insurance specifically. Various analyses identify the impact of global trends and key data on marine insurance. A pilot project for establishing a major claims database was carried out. The committee partnered with other IUMI committees to investigate relevant issues and strengthened its relationships with established and new data providers. Committee members represent a wide pool of knowledge in terms of geography and specific areas of competence.

Economy and trade

Growth of the global economy continues to accelerate and reached its fastest pace since 2010 in 2018. Commodity prices will rise only gradually, if at all, but generally the outlook is more positive than it has been for a while. Uncertainty remains as to how changes in national trading policies, Brexit, financial uncertainties and ongoing conflicts in various parts of the world will influence the future macroeconomic development.

Shipping and offshore energy markets

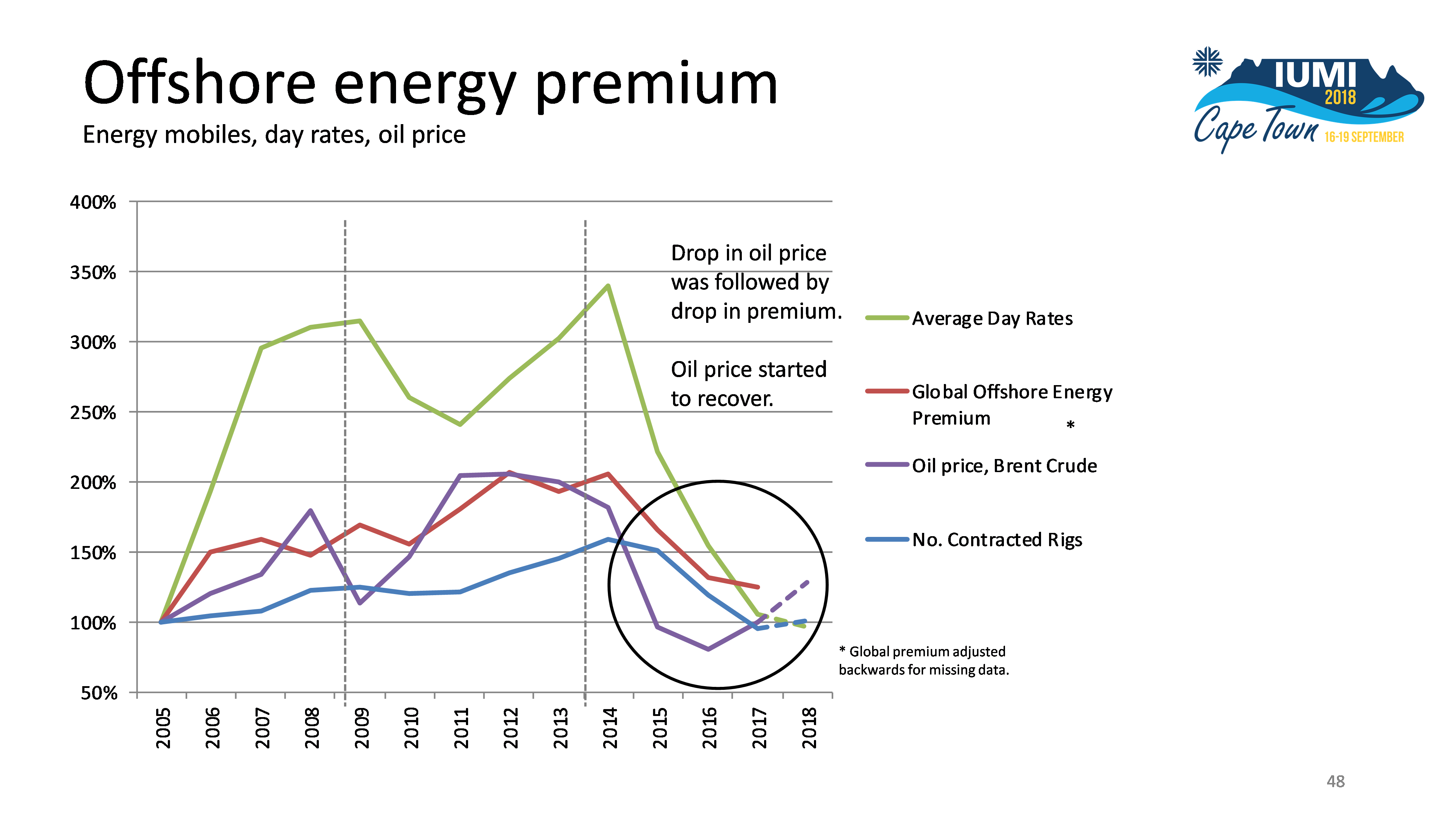

World fleet growth is easing, and the average fleet age is increasing. Ship earnings are improving, but still competitive. Since the oil price started to rally in 2017, activity in the offshore sector has started to gain traction again.

The global marine insurance market

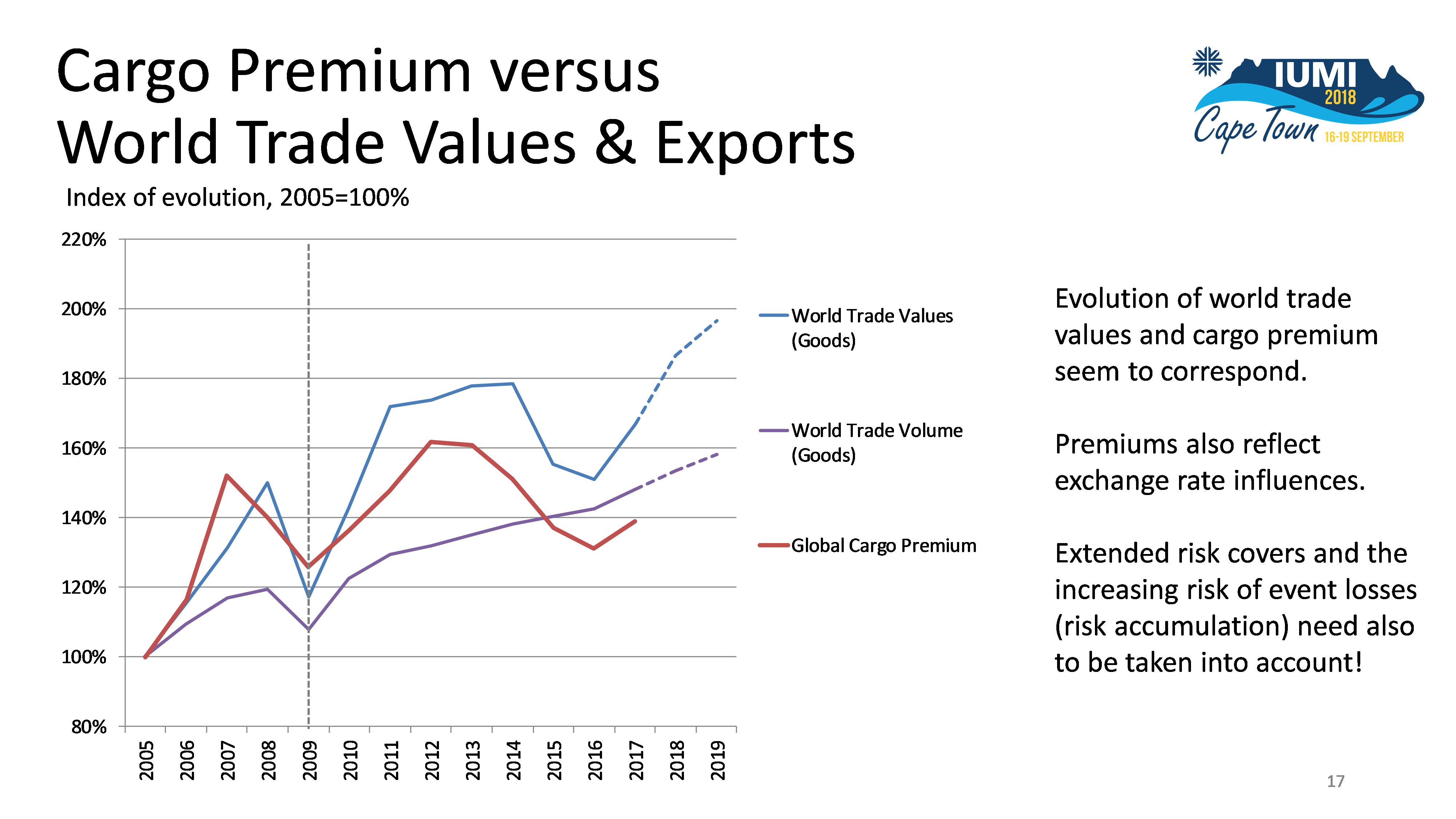

Cargo: While the upswing in global trade triggered a 6% increase in the overall cargo premium, cargo insurance results in recent years were heavily impacted by large event losses (Tianjin, satellite, hurricanes/nat-cat, Mærsk Honam). Increasing risk accumulation on single sites is a challenge which needs better monitoring, but also increasing expenses and coverage extensions are a concern.

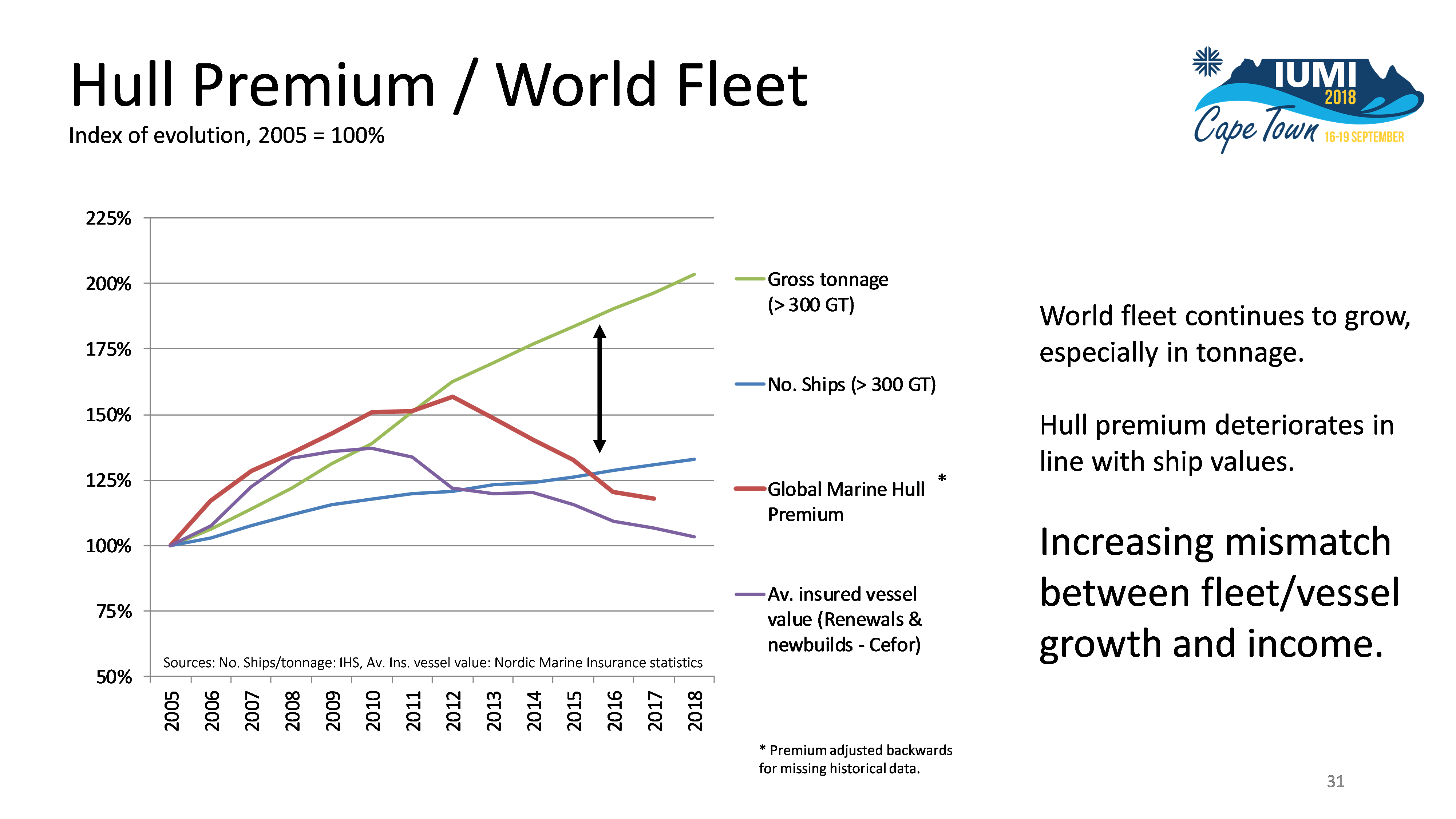

Hull: The overall hull premium was down 2.3% in 2017 but comparing the hull premium and average vessel values to the world fleet development reveals an increasing mismatch between fleet growth and hull income. This development is also reflected in the global hull insurance results, which continued to deteriorate substantially over the last three years. This is despite a benign claims environment with few major losses and moderate claims frequency and cost. The only extraordinary claims impact on the 2017 results came from hurricane losses on yachts.

Offshore Energy: After two years with more than a 20% drop in the offshore premium, the decrease flattened out in 2017 after the oil price started to rally. With the reduced activity followed a modest major claims impact, but with substantially reduced income levels attritional losses took an increasing share of the premium. Through renewed activity in the sector the outlook is currently more positive, but the claims potential arising from the reactivation of complex offshore units is a concern.

In general, the market environment is improving in all segments. However, sustainability of results can only be achieved by a robust risk evaluation taking into account all risk aspects, such as scope of coverage, characteristics of the covered risks, accumulation scenarios, climate change, new technology and the combined effect on expected claims costs.

For more insight please look at the Facts and Figures publications at https://iumi.com/statistics:

- Report on Merchant fleet and world trade (Donald Harrell):

- Global Marine Insurance Report (Astrid Seltmann) plus additional data for download

- Fact sheets for cargo, hull and offshore energy

- Hull and cargo inflation indices