At the 2016 IUMI conference in Genova, the Facts and Figures Committee presented its annual update on the macroeconomic environment and shipping market (Patrizia Kern, Chairman) and the global marine insurance market (Astrid Seltmann, Vice Chairman). In addition, we were pleased to welcome as guest speaker Stephen Gordon, CEO of Clarksons Research, who updated the audience on the market conditions for shipping, trade and offshore energy.

The core messages from the Facts and Figures workshop included:

- Economic and financial uncertainty remain the only constant.

- Global recovery is expected to continue, but there are significant downside risks (economic growth/trade volumes /Chinese economy, low commodity prices/oil price, freight rates, Brexit/financial uncertainties in Euro area, emerging market crisis/Latin America, to name a few).

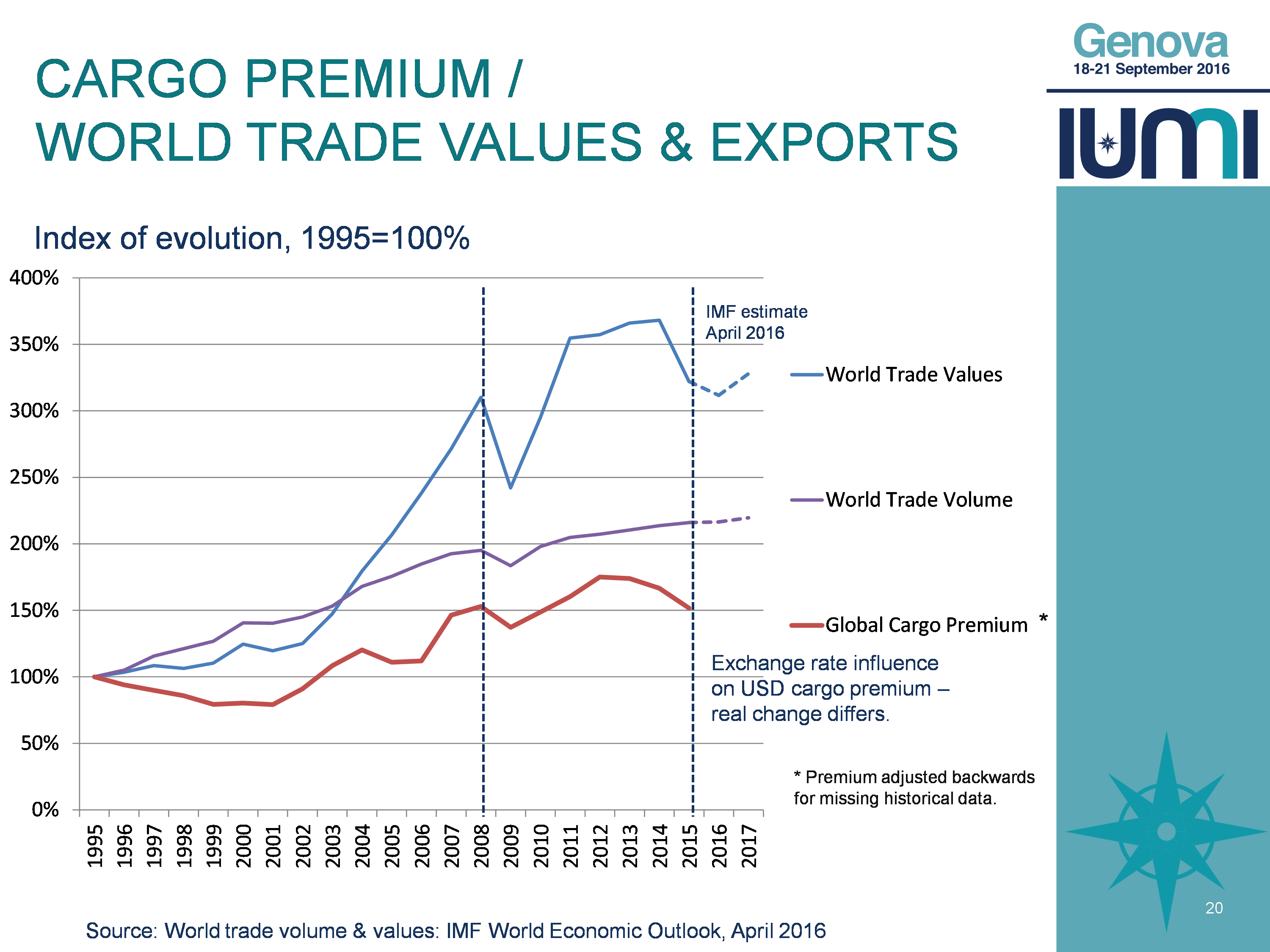

- The global marine premium decreased from 33.4 USD billion in 2014 to 29.9 USD billion in 2015, although the growth in world trade and the world fleet should support marine insurance demand (see graphs). While the strengthening of the US dollar contributed substantially to this reduction when converting figures to USD, it is not the only influencing factor. Most business lines suffered in 2015 with a real reduction in premium income due to a sluggish global economy, low commodity prices and reduced activity, especially in the offshore sector.

- The impact of major losses rose in 2015 back to the expected level, leaving 2014 as a stand-alone year with extraordinary few total and major losses.

- Technical results: The 2014 underwriting year results deteriorated for all lines as expected due to major claims which occurred in 2015, but attaching to 2014 contracts (cargo: Tianjin). The 2015 cargo loss ratio is also expected to deteriorate further, due to the not yet fully developed impact of Tianjin 2015 policies and the Hanjin bankruptcy.

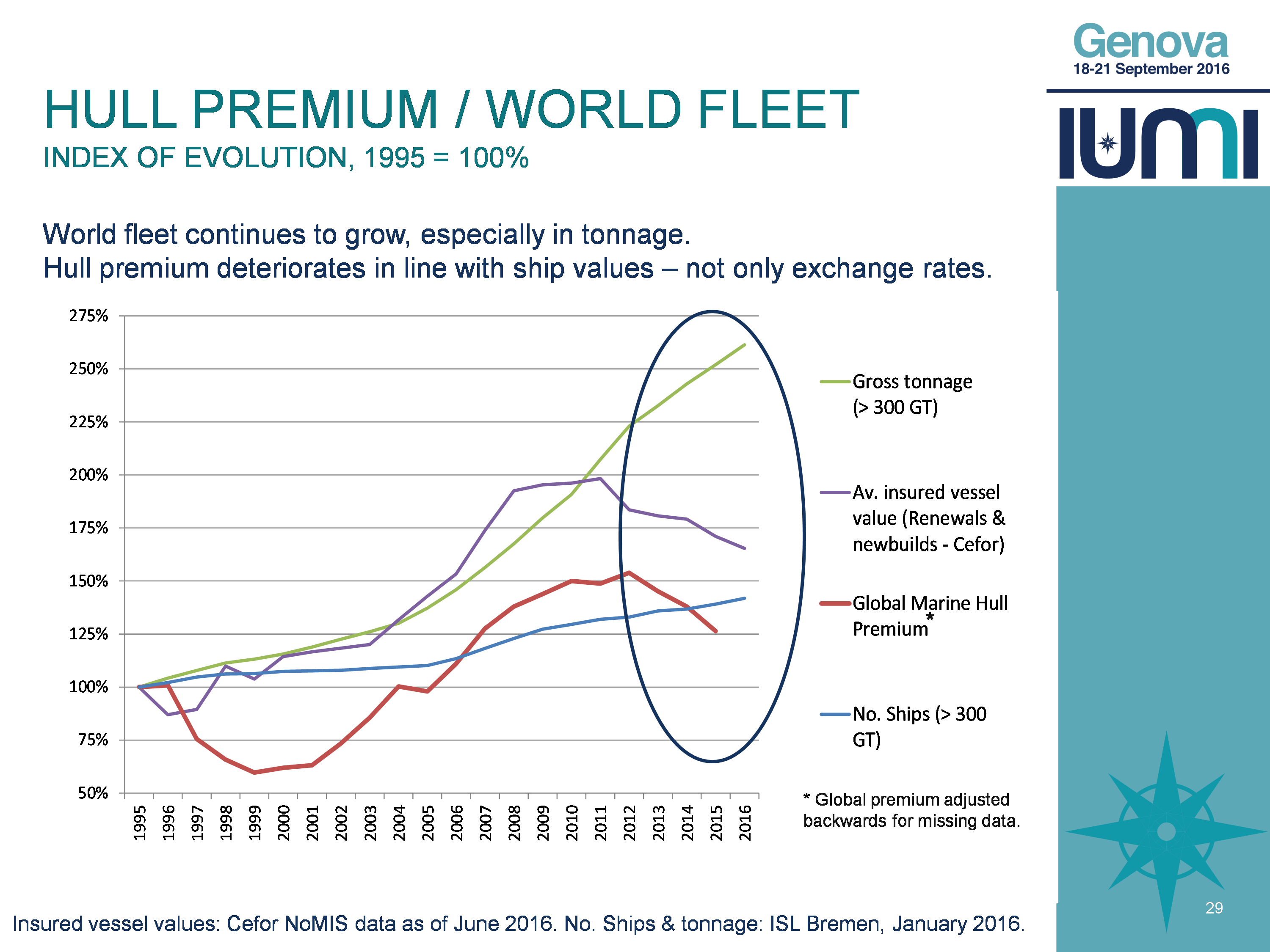

- Hull: The 2015 loss ratios is expected to end at a higher level than the 2014 loss ratio. While repair costs stayed stable, the increase must mainly be attributed to the renewed impact of total and major losses in combination with deteriorating insured values and accordingly the income.

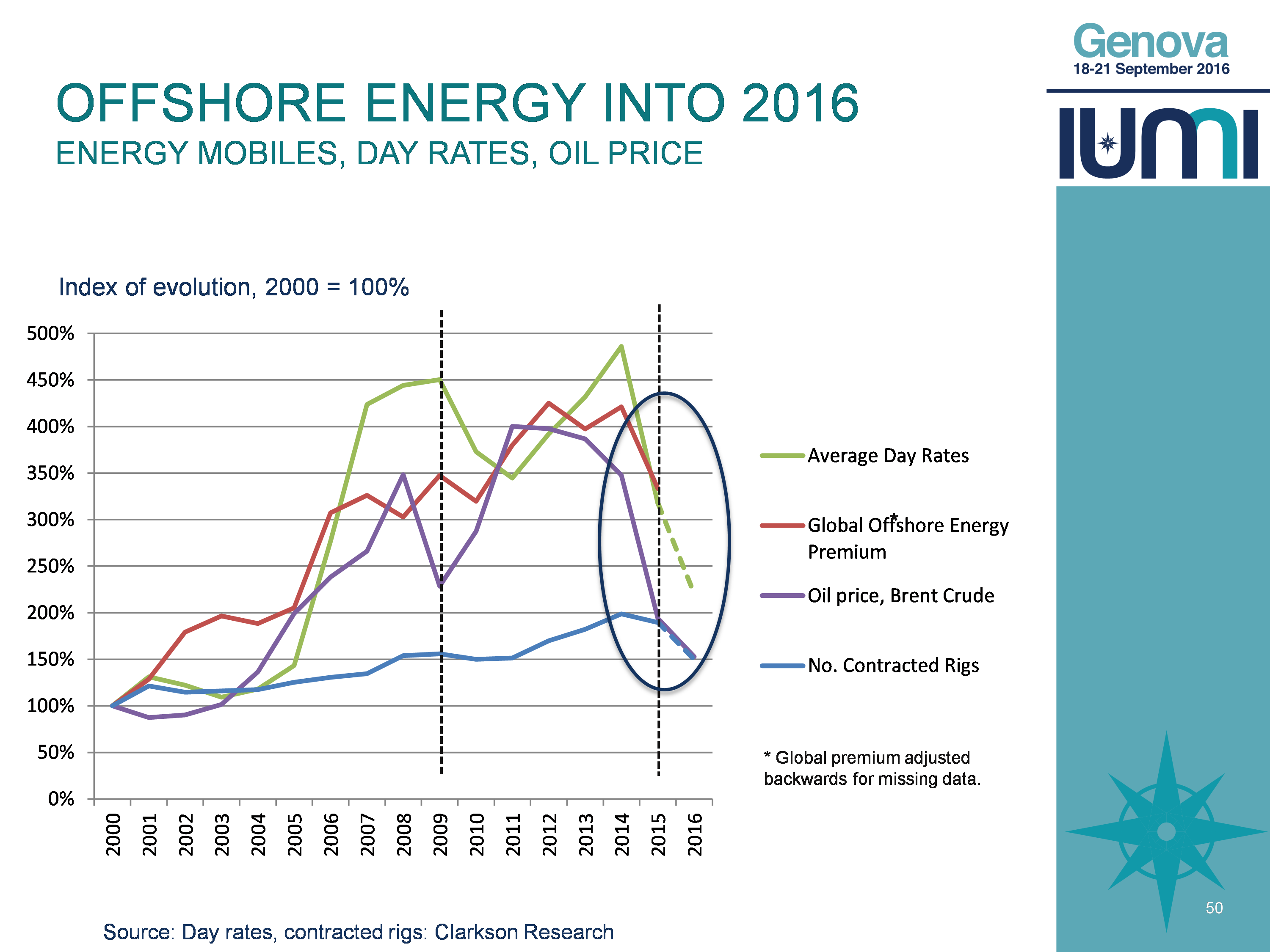

- Offshore Energy: The results of the youngest underwriting years are expected to deteriorate substantially due to the eroding income basis and major losses incurred in 2015. The future outlook is bleak due to the low oil price and consequently reduced activity in the offshore sector, but with high capacity and accordingly increased competition in the insurance sector.

- Increasing value accumulation (ports, larger high-value vessels) and consequently increased potential for new record claims are a major concern (2012: Costa Concordia, Hurricane Sandy, 2015: Tianjin explosions).

- Regulation, environment and technology changes are influencing and changing the industry.

- The 2016 market environment is challenging under stressed market conditions and the prevailing overcapacity in the marine insurance sector.

Please click here (hyperlink to presentations) for all updates on the market environment from the Facts & Figures Committee presentations.

In addition to the conference presentations, the Facts and Figures Committee provides the marine insurance industry with up-to-date key indicators including:

- Marine premiums by country for accounting years 2006 to 2015.

- Loss ratio triangulations for cargo, hull and offshore energy.

- Fact Sheets with relevant data for the hull, cargo and energy markets.

- Hull inflation index.

- Cargo inflation index.

- Each spring, IUMI issues extensive statistics on the hull, cargo and energy market including total and serious loss statistics, the world fleet development, offshore energy market and economic parameters.

Cargo Premium/World Trade Values & Exports

Hull Premium/World Fleet

Offshore Energy into 2016