Adoption of analytics by marine insurers reached a tipping point in 2019. At Windward, we’ve experienced a surge in adoption; by the end of the year we’ll have added 10 new insurance clients. It all demonstrates marine underwriters’ pragmatism and ability to adapt in a rapidly changing environment.

Thanks to AIS, we can now accurately assess vessel behaviour. Using machine learning techniques, we can build a picture of those behaviours which most strongly correlate with loss. And while loss records are an important factor in risk assessment, we’ve found that a vessel’s operational behaviour can better predict whether a casualty will occur in the future. Let’s take the utilisation profile as an example and explore how a vessel’s age and trading pattern affect risk.

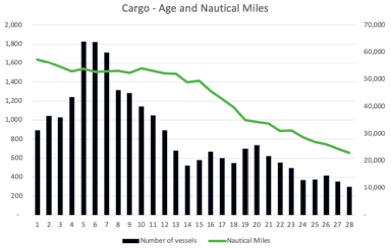

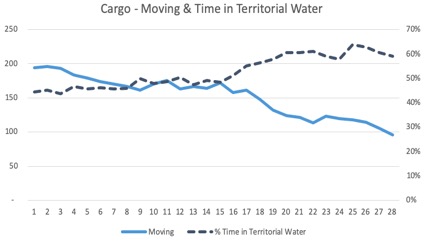

In the chart below, we see a steep decline in the number of older vessels and nautical miles sailed for ships over the age of 15. If we then overlay where those older vessels operate, we can see that not only are they used less, but they spend significantly more time trading in territorial waters than younger ones.

Our analysis also revealed that smaller general cargo vessels (<5,000DWT) spend one-third more time operating in shallow waters than larger ones. So it makes sense that small general cargo vessels are more than twice as likely to suffer a grounding than larger ones.

There are many other examples of how behavioural analysis can complement existing assumptions, some of which support and some of which contradict existing beliefs. Furthermore, there are vessel behaviours which strongly correlate with certain accident types which couldn’t be analysed until now, such as distinct number of port calls, time spent sailing at night, and trading patterns regularly exposed to severe weather.

Big data and AI can unlock competitive strategies and it is up to us on the analytics side to help underwriters find them. Technology can optimise delivery of underwriting information. It can enhance existing pricing models, help resolve complex claims faster, proactively identify risk factors, and refine risk management capabilities. Ultimately it will make the seas safer and help the maritime ecosystem thrive. The age of AI analytics has well and truly arrived.