In October 2024, new sanctions were imposed by the UK government on Russia’s “shadow fleet” for continuing to transport Russian oil and liquified natural gas. This is the latest in a growing number of sanctions arising out of geopolitical conflict around the world.

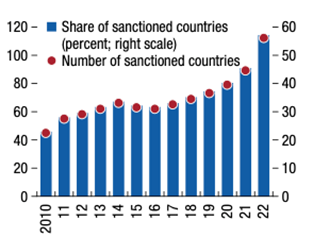

According to an IMF report, “bilateral financial sanctions have increased in recent years” meaning that the countries who have financial sanctions imposed against them has risen sharply. As this IMF chart shows, between 2010 and 2022, the number has more than doubled from 45 to 112. For marine insurers in particular, this adds an extra layer of due diligence when writing new policies or renewing existing ones.

Number of Countries with Financial Sanctions

Source: Global Financial Stability Report, IMF, April 2023

Sanctions compliance is crucial to the insurance industry, supporting ethical business practices and playing a part in safeguarding national security. There has been increased scrutiny from regulatory bodies on the sector recently, which has resulted in some significant fines imposed for violations.

This article, written by Moody's Industry Practice Lead and sanctions specialist, Hera Smith, talks about the role of sanctions and the responsibilities of insurance companies to implement robust compliance programmes. Hera also looks at how this can be achieved efficiently and effectively in the industry citing five pillars of sanctions compliance.

1. Management commitment

2. Risk assessment

3. Internal controls

4. Testing/auditing

5. Training

While it is incumbent on each insurance company or reinsurer to define how they approach sanctions compliance to detect risk, manage exposure, and prevent contraventions of regulations, these five pillars could help form the basis of their strategy.

Read the article to find out more and in particular how insurers and reinsurers can move away from manual processes, leveraging automation to ensure a responsive and efficient approach to sanctions compliance.