The insurance industry is utterly dependent on change. Change creates uncertainty, which creates unquantifiable risk, and the insurance industry has thrived off the resulting opportunities to pool this risk.

For a long time, this change has been largely unquantifiable, and the market leading insurers have built their success off the back of strong partnerships with their insureds. But, with increasing amounts of data (on just about everything) becoming available, insurers’ pursuit of prosperity has more recently become a race to the top in terms of who can accumulate the best information and make use of it.

The race to understand climate change

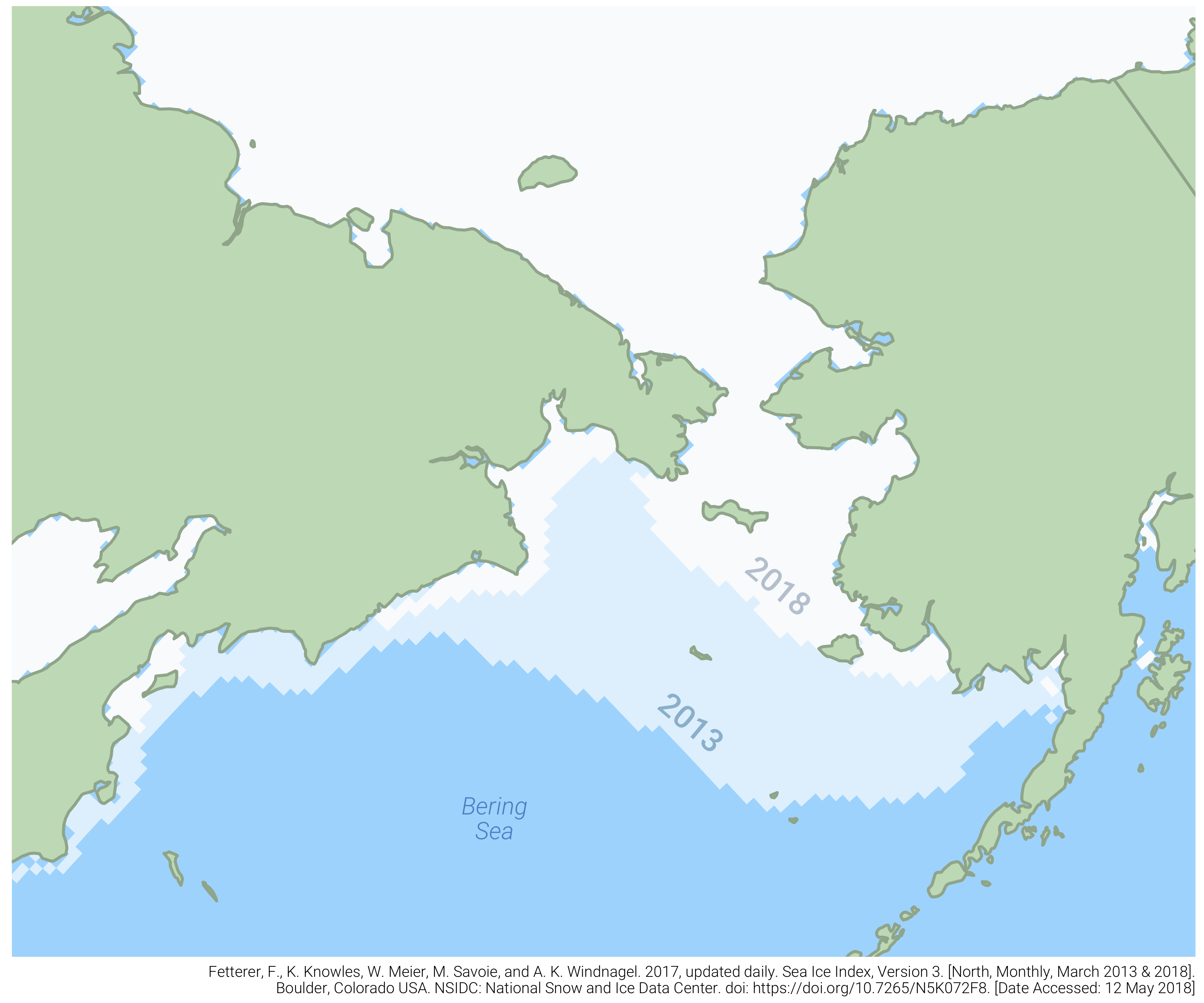

A global issue which is currently one of the biggest sources of uncertainty for insurers is climate change and, whilst politicians continue to debate the causes of the phenomenon, its effects are not up for discussion. Northern hemisphere sea ice extent, according to the National Snow & Ice Data Center (NSIDC), is currently at its lowest level (in terms of area) since records began [see below].

Figure 1: Comparison of sea ice extent in the Bering Sea, March 2013 vs. March 2018

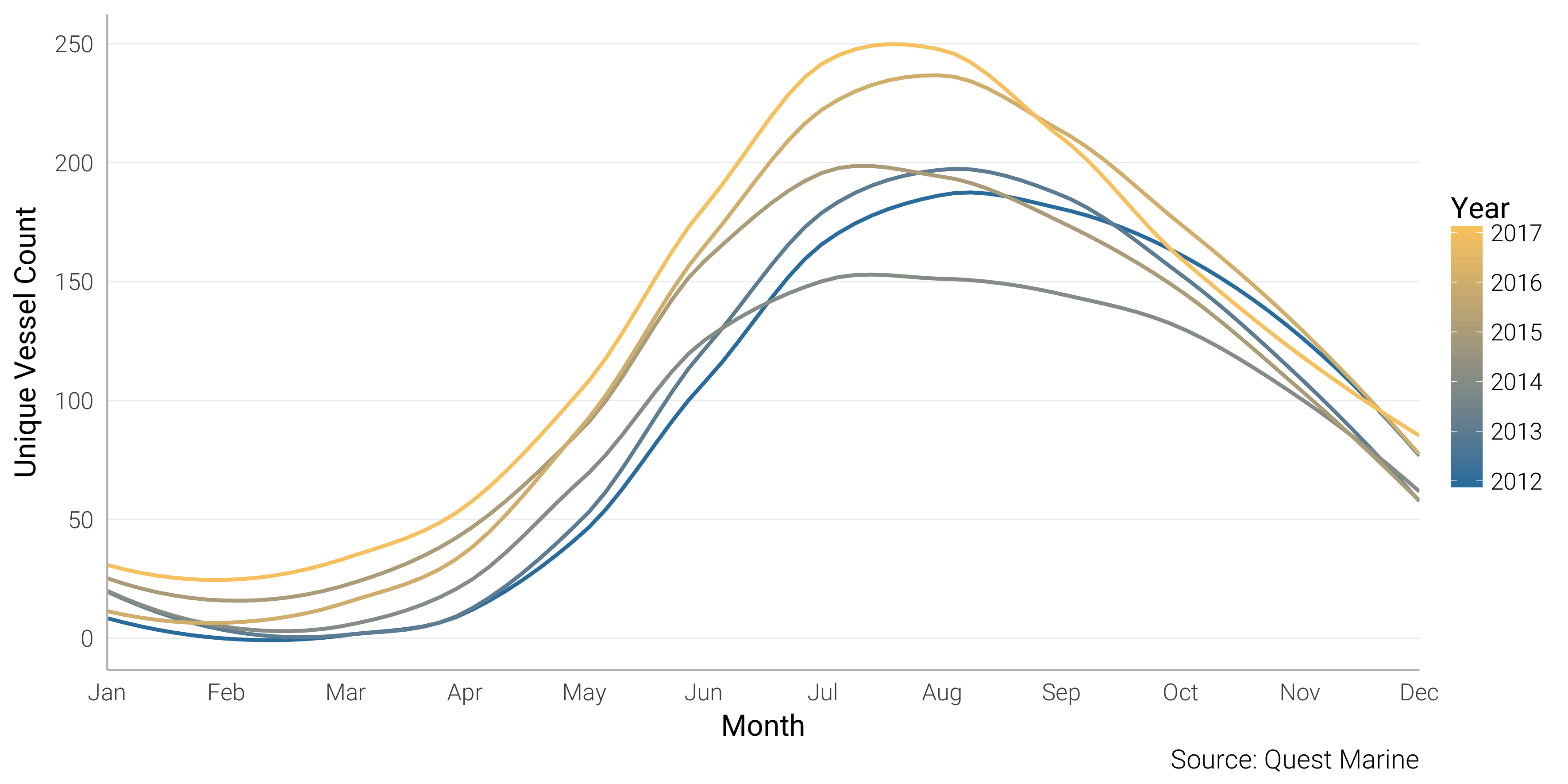

Quite aside from the environmental implications, this dearth of sea ice presents an extended window of opportunity for sea passage for ship owners, and data shows that operators are in fact capitalising on this opportunity.

Insurers, on the other hand, will be concerned with both measuring the impact on their exposure, and ensuring their policyholders are taking appropriate precautions for passage of such treacherous waterways.

Figure 2: Number of unique vessel incursions, by month and year, into the Bering Sea, north of 60oN. On an annual basis, the number of vessels entering this region increased by 18% between 2012 and 2017.

A real-time view of risk

However, with onboard technology and more accurate GPS partly contributing to the increase in data availability, insurers are able to harness this data and monitor exposures on an ongoing basis, meaning that incursions into these zones can be brought to their immediate attention.

Read more on the Concirrus blog about how insurers can automate this process, and the competitive advantage it can bring.