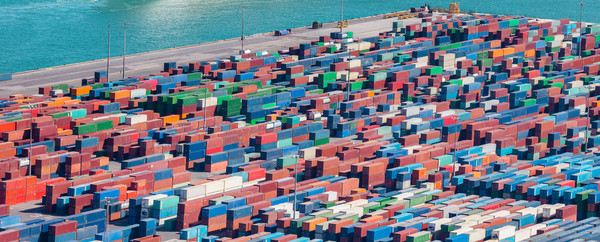

Today, supply chains are facing challenges which are unprecedented. These include unwarranted accumulation at ports, political (mis)adventurism, opaque trade deals, economic challenges such as inflation, currency fluctuations; and activities of those who want to thrive in the cyber playground without sticking to the rules.

These undercurrents can be reflected in the following ways.

- Trade route disruptions: the Suez Canal/Evergreen episode and recent acts of volatility in the Red Sea.

- Large container ships: high-capacity ships and port accumulations, as well as General Average and piracy incidents.

- Ghost ships: vessels without legitimate flag and/or class and without AIS are carrying cargo to circumvent sanctions.

- Outsourcing and political disruptions: new age trade wars, followed by embargoes and economic sanctions, is adding another layer of uncertainty for trade and commerce.

- Rising inflation due to high-cost raw materials and freight charges complemented by current exchange rate fluctuations, is another financial phenomenon that global supply chains must endure.

- Lastly, the cyber risk theatre is now more prominent and looming large to create ransomware, potentially interfering with vessel navigational systems.

These challenges have encouraged the marine insurance community to invest in a range of solutions:

As an insurer:

- focus on the nuances of supply chains such as transit policies with multiple transhipments and elements of storage, which are inevitable, during transit.

- Consider inflation in ascertaining limits both for transit and for storage.

- Customise scope of cover to suit the subtle requirements of clients including the basis of valuation, contingent insurable interest, etc.

- Speedy claim processing to maintain critical cash flow for assureds.

As a reinsurer:

- Have a presence, particularly in developing countries, across the world so that risks such as accumulation are spread.

- Create adequate capacities based on trade patterns.

- Suggest and share good underwriting practices to assist underwriters’ understanding.

- Encourage the industry to shy away from knee-jerk reactions to world events.

As a marine risk manager:

- Be in the front seat.

- Identify and contain physical attributes of the risk as the paramount rule of the game.

- Measures such as using drones, vessel tracking, geo-fencing, technology driven warranty surveys, etc. should be key to putting the client’s business at the core.

- Continuing engagement with the client’s logistics team will add an additional pair of eyes to identify subtle layers of risk exposure.

- Risk visibility will lead to its mitigation.

Global supply chains are changing but marine insurers, using technology and customised cover, will continue to deliver a robust and fit-for-purpose solution.

Thunderstorms demand actions whereas calm sunshine encourages good preparation.