In the film Moneyball, Peter Brand, the data savant played by Jonah Hill, says of one baseball player: “Nobody in the big leagues cares about him, because he looks funny.” The point: he’s been overlooked given the traditional interpretation of what makes someone valuable. Brand spies an opportunity to exploit the oversight by factoring in new data.

Like baseball officials influenced by their experience, our preferences are dictated by our knowledge. Preferences affect every aspect of our lives. Based on experience, they determine how we process information and shape our decision-making. Experience and wisdom are invaluable but can be limiting if we neglect to consider new data.

The strategic underwriter

When it comes to marine underwriting, experience is everything, allowing one to discern the relationship between fleets and risk. For new data sets to contribute to one’s risk assessment, they typically need to be observed over a longer period. But what if leveraging new data sets could contribute to our assessment of risk instantly? By assessing correlations between new types of data on vessels and previous accidents and claims history, it’s possible to find the most important data types which can be used to support decision-making.

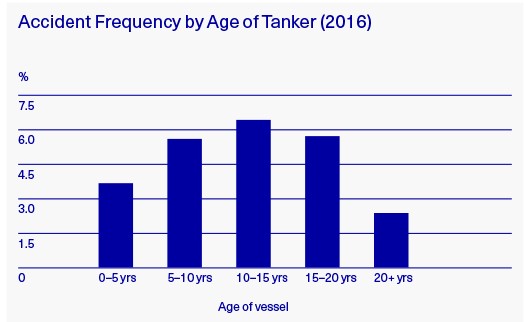

That said, correlations can be misleading. Take tankers, for example. Charterers prefer them to be under 15 years old given the implied safety risk of older vessels. Yet if we plot accident frequency against age, we see something surprising: vessels aged 20 and above appear to be the safest.

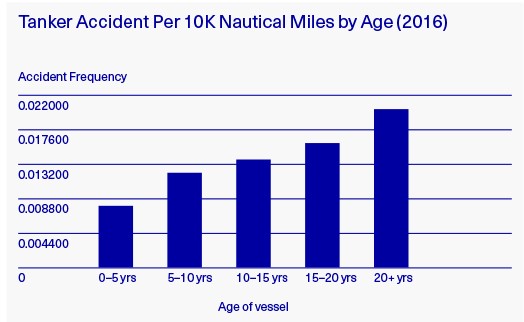

By factoring in new types of data we can explore this strange relationship. Here we discover that the low accident rate of older vessels is a function of their lower utilisation. If we look at accident frequency per nautical mile (NM) sailed, older vessels are more likely to incur losses.

For charterers it seems older vessels aren’t an option; the accident frequency is likely to increase as the vessel’s utilisation increases. But what does this mean for insurers? Underwriters are mainly concerned with risks over time rather than a specific voyage; most are likely to find the accident frequency of 20+ year old tankers tempting. However, when read in conjunction with new data types, such as total NM sailed, it’s clear age can’t be relied upon alone. How many miles are your assured’s sailing?