Global business leaders are assessing the full impact of COVID-19 with a focus on getting the economy back on track. Here we look at the latest global vessel movement trends to see if the shipping industry is showing signs of recovery.

May 2020 saw the following activity compared to 2019:

- A 10% global reduction in weekly distance travelled by containerships.

- Reductions in containership average weekly port visits across multiple regions.

- A 70.5% global reduction in distance travelled by cruise ships.

- Challenging risk aggregations of cruise ships in the Caribbean ahead of hurricane season.

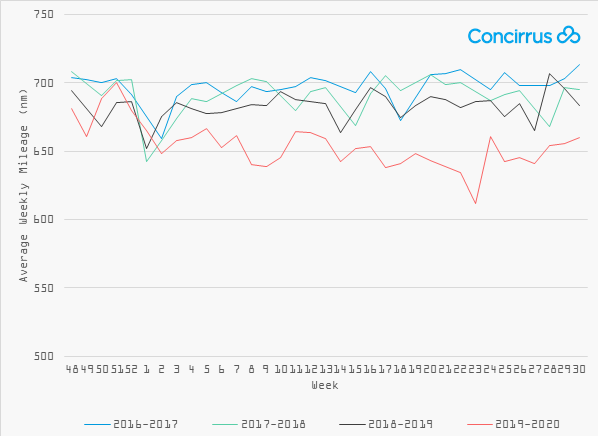

Three months on, global vessel data shows that average weekly mileage is increasing steadily.

Figure 1: Average weekly mileage – global, all vessels

Figure 1: Average weekly mileage – global, all vessels

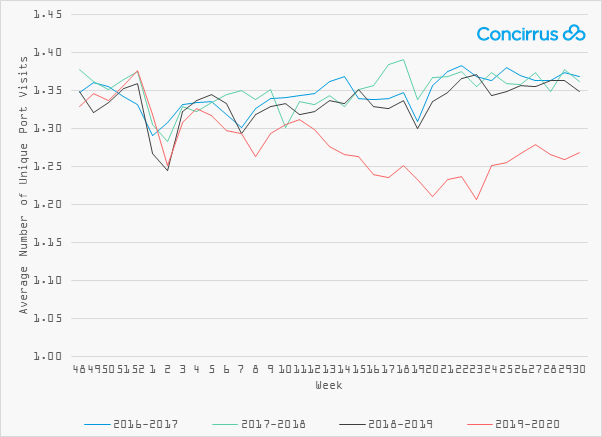

Global vessel mileage levels were down by just 3.5% vs 2019 at the end of July 2020. However, average weekly unique port visits haven’t stabilised at the same rate. During March 2020, average weekly port visits were 11.7% lower than in 2019. At the end of July, port activity still lagged by 5.9%.

Figure 2: Average weekly unique port visits – global, all vessels

Figure 2: Average weekly unique port visits – global, all vessels

It’s expected that port activity will continue to return towards normal levels as international trade resumes. However, as some ports are operating at reduced capacity, we could see a backlog of goods and therefore risk aggregations at key storage locations.

The cruise sector has seen the largest reduction in activity throughout the pandemic yet is showing a slight increase in port visits in recent weeks. Average weekly distance travelled reduced by 70.5% and average weekly port visits by 78.4% compared to 2019 figures. It will take some time for the cruise ship sector to return to normal operating levels due to extended restrictions and a reluctance from passengers to return.

Whilst global vessel data shows improvement, further analysis uncovers a variety of implications for specific sectors and regions. For the insurance community this level of detail is extremely important for effective risk management and customer engagement. A more detailed breakdown can be found HERE.