Accidents happen. That much we know. Why they happen, where and to whom are not always clear. Was the weather to blame? Did the captain fall asleep at the wheel? Did someone blind the Cyclops and incur the wrath of Poseidon?

But what if, for example, we knew which vessels were more likely to spend an unhealthy amount of time in bad weather? What if we could use this - and other dynamic vessel data - together with static ship characteristics, to predict the likelihood of an accident, and the vessels that were more likely to have them? Turns out we can. It all comes down to a ship’s operational profile.

Take Geography. Our analysis shows that vessels travelling for longer periods at night at dangerous depths are 2.6 times more likely to have contact accidents in the following year.

Or how about navigation? We’ve established that vessels travelling for long periods in congested traffic lanes are twice as likely to have collision accidents in the next 12 months.

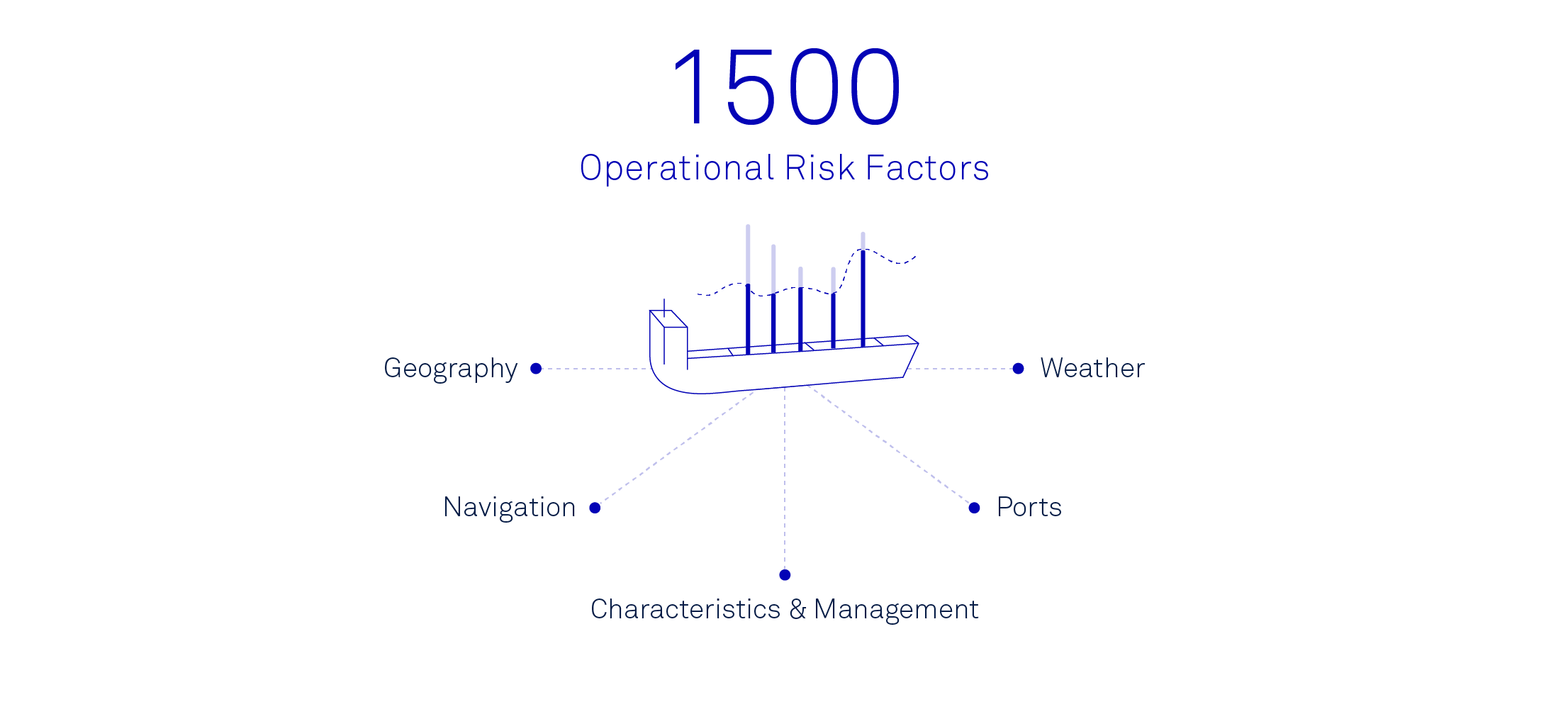

Overall, there are more than 1,500 such operational risk factors. They range from management-related features to activities in and around ports. But this data is far too big and granular to effectively support underwriting decisions.

That’s where machine learning models come in. They accurately rate the risk of every ship for the year ahead. Trained on thousands of past claims, the models learn which data points are important, how they interact and what their marginal impact will be. In this way they can crunch the hundreds of data points from the operational profile and allocate them a risk decile: the higher the decile the greater the likelihood of the ship having an accident - and loss - in the year ahead.

In this way, underwriters can augment their decisions with objective data insights, complementing their human intel, and enabling them to focus on building new, and more sustainable business relationships.

By using technology, we can augment the art of risk selection, improving the very core of the underwriting process.